Sarah's Blog

Sarah's Blog

The Latest Kamloops Real Estate News

Canadian Housing Starts (July) - August 11, 2020

Canadian Housing Starts (July) - August 11, 2020

Canadian housing starts increased by 16% m/m to 245,604 units in July at a seasonally adjusted annual rate (SAAR), which was well above pre-COVID levels . This brought up the national housing starts six month average to 204,376 units SAAR. Housing starts were up across the country with notable growth in the Prairies and Atlantic Canada.

In BC, housing starts was up 9% m/m to 42,381 units SAAR in July, following an increase of 38,840 in June. The increase was primarily driven by the multi-unit segment. Housing starts in July are back at pre-COVID levels. That being said, housing starts in the province showed resilience during the height of the pandemic when restrictions were the tightest. In the near term, we can expect housing activity to continue to be supported by pent-up demand and historically low borrowing rates. Compared to the same time last year, housing starts are down by 16%. Meanwhile, the value of residential building permits for June was up by 20% in the province.

Source: https://www.bcrea.bc.ca/

NEW LISTING - 855 GEORGEANN ROAD, KAMLOOPS

NEW LISTING - 855 GEORGEANN ROAD, KAMLOOPS

2 BEDROOM SINGLE FAMILY HOME ON A LARGE GLAT YARD IN A QUIET WESTWYDE NEIGHBORHOOD

OFFERED AT $379,000

Feature Listing - 813-15 HUDSONS BAY TRAIL, KAMLOOPS

Feature Listing - 813-15 HUDSONS BAY TRAIL, KAMLOOPS

2 BEDROOM/3 BATHROOM DETACHED TOWNHOUSE WITH VIEW

OFFERED AT $495,000

BC Homes Sales to Post Strong Recovery in 2021

BCREA 2020 Second Quarter Housing Forecast

BC Homes Sales to Post Strong Recovery in 2021

BCREA 2020 Second Quarter Housing Forecast

Vancouver, BC – June 10, 2020. The British Columbia Real Estate Association (BCREA) released its 2020 Second Quarter Housing Forecast today.

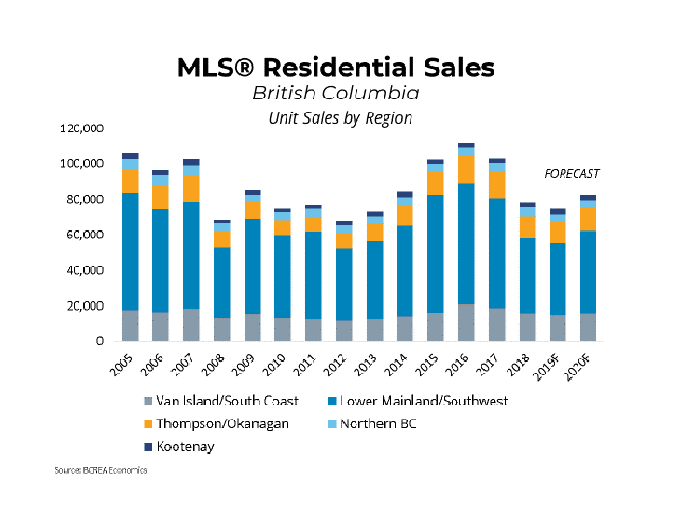

Multiple Listing Service® (MLS®) residential sales in the province are forecast to decline 21 per cent to approximately 61,000 units this year, after recording 77,347 residential sales in 2019. MLS® residential sales are forecast to increase 45.3 per cent to 88,500 units in 2021. “The bright outlook for 2020 home sales has been upended by the COVID-19 pandemic and resulting recession,” said Brendon Ogmundson, BCREA Chief Economist. “However, as the economy “re-opens” and measures to mitigate the spread of COVID-19 are gradually eased, we expect home sales will start to rebound, aided by record-low mortgage rates and pent-up demand.” The impact of the current pandemic and associated recession on prices is largely determined by the reaction of supply. Given the unusual nature of COVID-19, the supply of listings for sale has declined for at least the first few months of the pandemic. A muted rise in for-sale inventory may translate to home prices remaining relatively firm in 2020. We are forecasting the provincial MLS® average price to finish the year up 1.8 per cent and to increase a further 5.6 per cent in 2021.

NEW LISTING: 545 MONARCH DRIVE, SAHALI, KAMLOOPS

OFFERED AT $650,000

NEW LISTING: 545 MONARCH DRIVE, SAHALI, KAMLOOPS

OFFERED AT $650,000

4 Bedroom/3 bathroom Two-storey Family Home in a Prime Location of the Sahali Neighborhood, Kamloops

NEW LISTING: 44-2400 OAK DALE WAY, Kamloops

Offered at $89,000

NEW LISTING: 44-2400 OAK DALE WAY, Kamloops

Offered at $89,000

Updated 2 Bedroom / 1 Full Bathroom home in a quiet Senior (55+) section at Oak Dale Park in Westsyde

BCREA Housing Market Update (May 2020)

BCREA Housing Market Update (May 2020)

Watch BCREA Chief Economist Brendon Ogmundson discuss the April 2020 statistics.

347-1560 SUMMIT DRIVE - SOLD for $166,500

347-1560 SUMMIT DRIVE - SOLD for $166,500

1 BEDROOM CONDO ON TOP FLOOR IN A GREAT LOCATION-SAHALI

NEW LISTING: 436 Malahat Place, Kamloops

Offered at $494,000

NEW LISTING: 436 Malahat Place, Kamloops

Offered at $494,000

3 Bedroom, 3 bathroom 3-Level Split Bright, Cheery Family Home with Loads of Natural Light Throughout in a Sought-after Neighborhood

NEW LISTING: 1547 Hillcrest Ave., Kamloops

Offered at $445,000

NEW LISTING: 1547 Hillcrest Ave., Kamloops

Offered at $445,000

2 Bedroom, 3 bathroom Family Home with Tons of Natural Light & 18x36 Inground Pool

NEW LISTING: Unit 347-1560 Summit Drive, Kamloops

Offered at $172,500

NEW LISTING: Unit 347-1560 Summit Drive, Kamloops

Offered at $172,500

ONE SPACIOUS BEDROOM 4-PIECE BATHROOM Condo/ CLOSE TO ALL AMENITIES /SUB AREA: SAHALI

Canadian Housing Starts (Mar) - April 8, 2020

Canadian housing starts decreased by 7.3% m/m in March to 195,174 units at a seasonally adjusted annual rate (SAAR). The decrease was broad-based with starts down in 7 of 10 provinces, signalling early signs of the impact of COVID-19 on construction activity. The trend in national housing starts fell to a still healthy average of 205,000 units SAAR over the past six months.

In BC, housing starts fell by 20% m/m to 34,014 units SAAR, following a 44% rise in the previous month. The decrease was entirely driven by multi-units (-25%), while singles increased (1%). Given the rapidly evolving circumstances brought on by COVID-19, Statistics Canada released early estimates of March building permits for select regions (covering 29% of total building permit values). Early estimates show permits falling by 23% in Canadian cities compared to the same time last year. The strongest declines were in Ontario (-51%), BC (-27%) and Quebec (-38%), likely due to recent announcements in Ontario and Quebec to halt many construction projects. Meanwhile in BC, earlier reported cases of COVID-19 compared to other regions likely started to slow construction intentions. In the near term, new construction activity will continue to slow across the country as physical distancing measures persist.

Looking at census metropolitan areas in BC:

Housing starts in Vancouver were up by 3% in March to 21,236 units SAAR, driven entirely by multi-units (6%), while singles were down (-10%). Compared to last year in March, housing starts were up by 1%.

In Victoria, housing starts were down by 79% m/m to 1,226 units SAAR, which follows last month's strong showing of 5,931 units. Compared to a year ago in March, housing starts were down by 41%.

In Kelowna, housing starts decreased by 61% m/m to 1,504, following a 1,129% increase in the previous month. Starts were up by 161% in the region compared to the same time last year.

Monthly housing starts in Abbotsford-Mission were down by 79% at 669 units SAAR, following last month's 2,738 units. Compared to the same time last year, new home construction was down by 64%.

Canadian Housing Starts (Mar) - April 8, 2020

Canadian housing starts decreased by 7.3% m/m in March to 195,174 units at a seasonally adjusted annual rate (SAAR). The decrease was broad-based with starts down in 7 of 10 provinces, signalling early signs of the impact of COVID-19 on construction activity. The trend in national housing starts fell to a still healthy average of 205,000 units SAAR over the past six months.

In BC, housing starts fell by 20% m/m to 34,014 units SAAR, following a 44% rise in the previous month. The decrease was entirely driven by multi-units (-25%), while singles increased (1%). Given the rapidly evolving circumstances brought on by COVID-19, Statistics Canada released early estimates of March building permits for select regions (covering 29% of total building permit values). Early estimates show permits falling by 23% in Canadian cities compared to the same time last year. The strongest declines were in Ontario (-51%), BC (-27%) and Quebec (-38%), likely due to recent announcements in Ontario and Quebec to halt many construction projects. Meanwhile in BC, earlier reported cases of COVID-19 compared to other regions likely started to slow construction intentions. In the near term, new construction activity will continue to slow across the country as physical distancing measures persist.

Looking at census metropolitan areas in BC:

Housing starts in Vancouver were up by 3% in March to 21,236 units SAAR, driven entirely by multi-units (6%), while singles were down (-10%). Compared to last year in March, housing starts were up by 1%.

In Victoria, housing starts were down by 79% m/m to 1,226 units SAAR, which follows last month's strong showing of 5,931 units. Compared to a year ago in March, housing starts were down by 41%.

In Kelowna, housing starts decreased by 61% m/m to 1,504, following a 1,129% increase in the previous month. Starts were up by 161% in the region compared to the same time last year.

Monthly housing starts in Abbotsford-Mission were down by 79% at 669 units SAAR, following last month's 2,738 units. Compared to the same time last year, new home construction was down by 64%.

1,407 listings

AVG

MIN

MAX

1,407 listings

AVG

MIN

MAX

$495 per sqft.

AVG

MIN

MAX

BCREA Housing Market Update (April 2020)

BCREA Housing Market Update (April 2020)

Watch BC Real Estate Association (BCREA) Chief Economist Brendon Ogmundson discuss the March 2020 statistics.

Pandemic Halts Sales Activity in March 2020

Vancouver, BC – April 15, 2020.

The British Columbia Real Estate Association (BCREA) reports that a total of 6,717 residential unit sales were recorded by the Multiple Listing Service® (MLS®) in March 2020, an increase of 17.2 per cent from March 2019. The average MLS® residential price in BC was $789,548, a 15.1 per cent increase from $685,892 recorded the previous year. Total sales dollar volume in March was $5.3 billion, a 35 per cent increase over 2019.

“Provincial housing markets started the month very strong before the COVID-19 pandemic put a halt to activity,” said BCREA Chief Economist Brendon Ogmundson. “Activity will slow considerably in April as households and the real estate sector implement measures necessary to mitigate the spread of this virus.”

“While we don’t know when this unprecedented period will end, markets will be boosted by pent-up demand and historically low interest rates when it does,” added Ogmundson. “The ultimate strength of the recovery will depend on how long the economy remains effectively shut down, as well as the efficacy of federal and provincial measures to bridge households through the financial difficulties brought on by the pandemic.”

Year-to-date, BC residential sales dollar volume was up 37.1 per cent to $12.9 billion, compared with the same period in 2019. Residential unit sales increased 21.7 per cent to 16,866 units, while the average MLS® residential price was up 12.6 per cent to $763,031.

Pandemic Halts Sales Activity in March 2020

Vancouver, BC – April 15, 2020.

The British Columbia Real Estate Association (BCREA) reports that a total of 6,717 residential unit sales were recorded by the Multiple Listing Service® (MLS®) in March 2020, an increase of 17.2 per cent from March 2019. The average MLS® residential price in BC was $789,548, a 15.1 per cent increase from $685,892 recorded the previous year. Total sales dollar volume in March was $5.3 billion, a 35 per cent increase over 2019.

“Provincial housing markets started the month very strong before the COVID-19 pandemic put a halt to activity,” said BCREA Chief Economist Brendon Ogmundson. “Activity will slow considerably in April as households and the real estate sector implement measures necessary to mitigate the spread of this virus.”

“While we don’t know when this unprecedented period will end, markets will be boosted by pent-up demand and historically low interest rates when it does,” added Ogmundson. “The ultimate strength of the recovery will depend on how long the economy remains effectively shut down, as well as the efficacy of federal and provincial measures to bridge households through the financial difficulties brought on by the pandemic.”

Year-to-date, BC residential sales dollar volume was up 37.1 per cent to $12.9 billion, compared with the same period in 2019. Residential unit sales increased 21.7 per cent to 16,866 units, while the average MLS® residential price was up 12.6 per cent to $763,031.

1,407 listings

AVG

MIN

MAX

1,407 listings

AVG

MIN

MAX

$495 per sqft.

AVG

MIN

MAX

1,407 listings

AVG

MIN

MAX

1,407 listings

AVG

MIN

MAX

$495 per sqft.

AVG

MIN

MAX

JUST SOLD for $550,000: 1105 RAVEN DRIVE (BATCHELOR HEIGHTS), KAMLOOPS BC

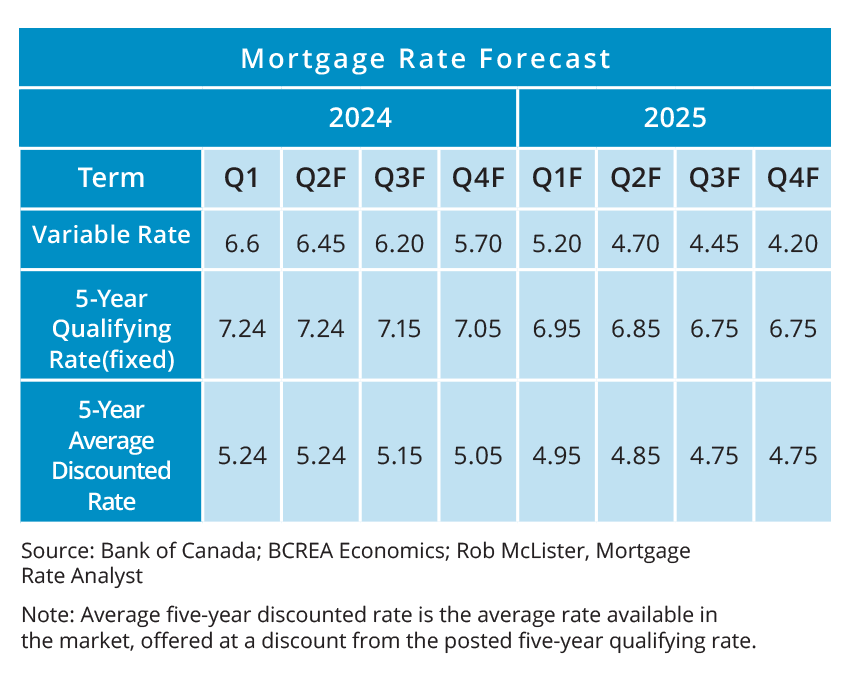

Mortgage Rate Forecast

Mortgage Rate Outlook

The growing fears of the potential impact of COVID-19 resulted in a full market meltdown in late February, sending equity markets into free fall and global bond yields plummeting. On top of an already volatile situation, two of the world's largest oil producers, Saudi Arabi and Russia, have engaged in a price war that sent oil prices to levels not seen since the late 1990s.

That panic sent Canadian bond yields down sharply and prompted emergency rate cutting by the Bank of Canada. Variable and 5-year fixed qualifying mortgage rates have followed bond yields lower with the 5 year fixed rate reaching 2.59 per cent, its lowest level since 2016 and very near its lowest level on record.How prolonged and just how serious this outbreak will be is still unknown, which makes forecasting extremely difficult. What we do know is that the economy is in for at least a quarter of significant loss of economic output as measures to stop the spread of COVID-19, such as social distancing, sheltering in place and mandatory business closures, put a halt to economic and social activity.

Though mortgage rates have started rising as risk increases, we anticipate that measures implemented by the government, the Bank of Canada and other global central banks will help to calm fears over financial system liquidity and stem a longer-term spike in bank funding costs and mortgage rates will once again decline as the economy recovers.

Of note, the Canadian government has postponed changes to the mortgage stress test. The qualifying rate for insured mortgages was set to change from the 5-year posted mortgage rate to the average 5-year fixed rate plus 200 basis points on April 6, with the B-20 stress test for uninsured mortgages to follow suit. By postponing this change, the government has muted the passthrough from monetary policy to the housing market, particularly since the 5-year posted rate has maintained at 5.19 per cent, despite the average 5-year contract rate falling to near historical lows. The impact of dramatically lower rates will still help those renewing or refinancing mortgages at lower rates by freeing up monthly cash-flow due to lower mortgage payments.

Economic Outlook

Economic growth in Canada slowed sharply to end 2019, even before supply chain disruptions due to both COVID-19 and interrupted rail service. Those factors alone were expected to slow growth in the first half of the year and now the Canadian economy is also dealing with plummeting oil prices resulting from a price war between Saudi Arabia and Russia.

There is tremendous uncertainty around the economic outlook beyond the first half of 2020 and a viral outbreak is not something that macroeconomists can model. The measures needed to stem the spread of infections are at odds with robust economic activity, which means we will see a sharp decline in retail sales, tourism, and other activity in the coming months. Adding to that uncertainty is the dramatic drop in oil prices, which in the past has been enough on its own to turn Canadian GDP growth negative.

In model simulations, we estimate the combined impact of COVID-19 and the oil shock will tip the Canadian economy into a recession, including what may be a historic drop in output in the second quarter, followed by a robust recovery as activity returns to normal and the impact of the government's fiscal stimulus kicks in.

Interest Rate Outlook

The Bank of Canada lowered its overnight rate by 100 basis points in the span of a week, an unprecedented action that is likely to be followed by subsequent rate reductions. With the economy facing a sudden stop in economic activity, most other considerations for the Bank are on the back burner and we expect the Bank to bring its overnight policy rate to 0.25 per cent.

In the past, when the Bank has aggressively lowered its policy rate, it has taken up to 24 months before there was a rate increase. If economic activity does post a strong recovery in the second half of 2020, we expect the Bank will maintain its policy rate at 0.25 per cent for the remainder of the year

Source: https://www.bcrea.bc.ca/economics/mortgage-rate-forecast/

Mortgage Rate Forecast

Mortgage Rate Outlook

The growing fears of the potential impact of COVID-19 resulted in a full market meltdown in late February, sending equity markets into free fall and global bond yields plummeting. On top of an already volatile situation, two of the world's largest oil producers, Saudi Arabi and Russia, have engaged in a price war that sent oil prices to levels not seen since the late 1990s.

That panic sent Canadian bond yields down sharply and prompted emergency rate cutting by the Bank of Canada. Variable and 5-year fixed qualifying mortgage rates have followed bond yields lower with the 5 year fixed rate reaching 2.59 per cent, its lowest level since 2016 and very near its lowest level on record.How prolonged and just how serious this outbreak will be is still unknown, which makes forecasting extremely difficult. What we do know is that the economy is in for at least a quarter of significant loss of economic output as measures to stop the spread of COVID-19, such as social distancing, sheltering in place and mandatory business closures, put a halt to economic and social activity.

Though mortgage rates have started rising as risk increases, we anticipate that measures implemented by the government, the Bank of Canada and other global central banks will help to calm fears over financial system liquidity and stem a longer-term spike in bank funding costs and mortgage rates will once again decline as the economy recovers.

Of note, the Canadian government has postponed changes to the mortgage stress test. The qualifying rate for insured mortgages was set to change from the 5-year posted mortgage rate to the average 5-year fixed rate plus 200 basis points on April 6, with the B-20 stress test for uninsured mortgages to follow suit. By postponing this change, the government has muted the passthrough from monetary policy to the housing market, particularly since the 5-year posted rate has maintained at 5.19 per cent, despite the average 5-year contract rate falling to near historical lows. The impact of dramatically lower rates will still help those renewing or refinancing mortgages at lower rates by freeing up monthly cash-flow due to lower mortgage payments.

Economic Outlook

Economic growth in Canada slowed sharply to end 2019, even before supply chain disruptions due to both COVID-19 and interrupted rail service. Those factors alone were expected to slow growth in the first half of the year and now the Canadian economy is also dealing with plummeting oil prices resulting from a price war between Saudi Arabia and Russia.

There is tremendous uncertainty around the economic outlook beyond the first half of 2020 and a viral outbreak is not something that macroeconomists can model. The measures needed to stem the spread of infections are at odds with robust economic activity, which means we will see a sharp decline in retail sales, tourism, and other activity in the coming months. Adding to that uncertainty is the dramatic drop in oil prices, which in the past has been enough on its own to turn Canadian GDP growth negative.

In model simulations, we estimate the combined impact of COVID-19 and the oil shock will tip the Canadian economy into a recession, including what may be a historic drop in output in the second quarter, followed by a robust recovery as activity returns to normal and the impact of the government's fiscal stimulus kicks in.

Interest Rate Outlook

The Bank of Canada lowered its overnight rate by 100 basis points in the span of a week, an unprecedented action that is likely to be followed by subsequent rate reductions. With the economy facing a sudden stop in economic activity, most other considerations for the Bank are on the back burner and we expect the Bank to bring its overnight policy rate to 0.25 per cent.

In the past, when the Bank has aggressively lowered its policy rate, it has taken up to 24 months before there was a rate increase. If economic activity does post a strong recovery in the second half of 2020, we expect the Bank will maintain its policy rate at 0.25 per cent for the remainder of the year

Source: https://www.bcrea.bc.ca/economics/mortgage-rate-forecast/

1,407 listings

AVG

MIN

MAX

1,407 listings

AVG

MIN

MAX

$495 per sqft.

AVG

MIN

MAX

Market Momentum Continues into the Fall

Vancouver, BC - October 15, 2019. The British Columbia Real Estate Association (BCREA) reports that a total of 6,938 residential unit sales were recorded by the Multiple Listing Service® (MLS®) in September, an increase of 24 per cent from the same month last year. The average MLS® residential price in the province was $697,943, an increase of 2.1 per cent from September 2018. Total sales dollar volume was $4.84 billion, a 26.5 per cent increase from the same month last year.

"Markets across BC built on momentum from the summer," said BCREA Chief Economist Brendon Ogmundson. "While the year-over-year increase in provincial sales was quite strong, home sales in most areas are simply returning to historically average levels."

MLS® residential active listings in the province were up 4 per cent from September 2018 to 39,117 units and were essentially flat compared to August on a seasonally adjusted basis. Overall market conditions remained in a balanced range with a sales-to-active listings ratio of about 18 per cent.

Year-to-date, BC residential sales dollar volume was down 12.4 per cent to $39.7 billion, compared with the same period in 2018. Residential unit sales were 8.9 per cent lower at 57,773 units, while the average MLS® residential price was down 3.9 per cent year-to-date at $687,530.

Market Momentum Continues into the Fall

Vancouver, BC - October 15, 2019. The British Columbia Real Estate Association (BCREA) reports that a total of 6,938 residential unit sales were recorded by the Multiple Listing Service® (MLS®) in September, an increase of 24 per cent from the same month last year. The average MLS® residential price in the province was $697,943, an increase of 2.1 per cent from September 2018. Total sales dollar volume was $4.84 billion, a 26.5 per cent increase from the same month last year.

"Markets across BC built on momentum from the summer," said BCREA Chief Economist Brendon Ogmundson. "While the year-over-year increase in provincial sales was quite strong, home sales in most areas are simply returning to historically average levels."

MLS® residential active listings in the province were up 4 per cent from September 2018 to 39,117 units and were essentially flat compared to August on a seasonally adjusted basis. Overall market conditions remained in a balanced range with a sales-to-active listings ratio of about 18 per cent.

Year-to-date, BC residential sales dollar volume was down 12.4 per cent to $39.7 billion, compared with the same period in 2018. Residential unit sales were 8.9 per cent lower at 57,773 units, while the average MLS® residential price was down 3.9 per cent year-to-date at $687,530.

1,407 listings

AVG

MIN

MAX

1,407 listings

AVG

MIN

MAX

$495 per sqft.

AVG

MIN

MAX

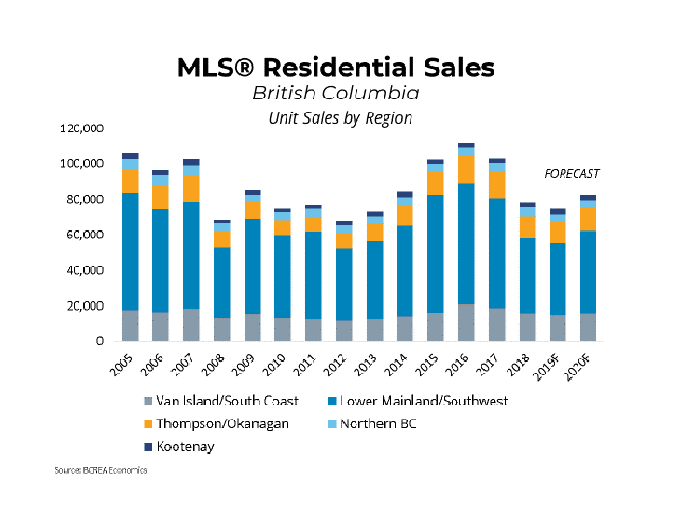

Vancouver, BC - September 5, 2019. The British Columbia Real Estate Association (BCREA) released its 2019 Third Quarter Housing Forecast Update today.

Multiple Listing Service® (MLS®) residential sales in the province are forecast to decline 5 per cent to about 75,000 units this year, after recording 78,505 residential sales in 2018. MLS® residential sales are forecast to increase 11 per cent to 82,700 units in 2020, just below the 10-year average for MLS® residential sales of 85,800 units.

Multiple Listing Service® (MLS®) residential sales in the province are forecast to decline 5 per cent to about 75,000 units this year, after recording 78,505 residential sales in 2018. MLS® residential sales are forecast to increase 11 per cent to 82,700 units in 2020, just below the 10-year average for MLS® residential sales of 85,800 units.

"BC markets are showing signs of recovery after nearly a year and a half of policy-induced declines," said Brendon Ogmundson, BCREA Deputy Chief Economist. "We expect that recovery to continue into next year, with home sales normalizing around long-term averages."

A recovery in home sales has slowed the accumulation of resale inventory, with active listings still well short of the previous peak in 2012. That leaves market conditions at the provincial level essentially balanced with little upward pressure on prices. We anticipate that the MLS® average price will decline 2.4 per cent in 2019 before rising modestly by 3 per cent to $718,000 in 2020.

Vancouver, BC - September 5, 2019. The British Columbia Real Estate Association (BCREA) released its 2019 Third Quarter Housing Forecast Update today.

Multiple Listing Service® (MLS®) residential sales in the province are forecast to decline 5 per cent to about 75,000 units this year, after recording 78,505 residential sales in 2018. MLS® residential sales are forecast to increase 11 per cent to 82,700 units in 2020, just below the 10-year average for MLS® residential sales of 85,800 units.

Multiple Listing Service® (MLS®) residential sales in the province are forecast to decline 5 per cent to about 75,000 units this year, after recording 78,505 residential sales in 2018. MLS® residential sales are forecast to increase 11 per cent to 82,700 units in 2020, just below the 10-year average for MLS® residential sales of 85,800 units.

"BC markets are showing signs of recovery after nearly a year and a half of policy-induced declines," said Brendon Ogmundson, BCREA Deputy Chief Economist. "We expect that recovery to continue into next year, with home sales normalizing around long-term averages."

A recovery in home sales has slowed the accumulation of resale inventory, with active listings still well short of the previous peak in 2012. That leaves market conditions at the provincial level essentially balanced with little upward pressure on prices. We anticipate that the MLS® average price will decline 2.4 per cent in 2019 before rising modestly by 3 per cent to $718,000 in 2020.

1,407 listings

AVG

MIN

MAX

1,407 listings

AVG

MIN

MAX

$495 per sqft.

AVG

MIN

MAX

1,407 listings

AVG

MIN

MAX

1,407 listings

AVG

MIN

MAX

$495 per sqft.

AVG

MIN

MAX

Housing Market Update Webcast September 2019

Housing Market Update Webcast September 2019

Watch BCREA Deputy Chief Economist Brendon Ogmundson discusses the August 2019 statistics.

845 REGENT CRES., KAMLOOPS BC

845 REGENT CRES., KAMLOOPS BC

5 BEDROOM 3 FULL BATH FAMILY HOME IN A GREAT ABERDEEN NEIGHBORHOOD

680 DUNCAN AVENUE, KAMLOOPS BC

680 DUNCAN AVENUE, KAMLOOPS BC

3 BEDROOM 2 BATH FAMILY HOME, SITUATED ON FLAT, PRIVATE LOT - ASKING PRICE: $425,000

JUST LISTED: 381 TUXFORD DRIVE, SAHALI, $610,000

-SOLD Within 4 Days in the Market-

JUST LISTED: 381 TUXFORD DRIVE, SAHALI, $610,000

-SOLD Within 4 Days in the Market-

UPDATED 4 BEDROOM/3 FULL BATHROOM RANCHER WITH FULLY FINISHED BASEMENT IN PRIME LOCATION

Video Webcasts / Housing Market Update

Video Webcasts / Housing Market Update

Housing Market Update (November 2018)

NEW LISTING: 6 WHITESHIELD CRES.S./SAHALI/$534,900

-SOLD-

NEW LISTING: 6 WHITESHIELD CRES.S./SAHALI/$534,900

-SOLD-

OPEN HOUSE: OCTOBER 13TH/SATURDAY/1:30 - 3 P.M

NEW LISTING-39-255 PEMBERTON TERR, SAHALI/$475,000

NEW LISTING-39-255 PEMBERTON TERR, SAHALI/$475,000

LOCATION IS UNBEATABLE! MINUTES WALK TO ALL AMENITIES!

NEW Price - 1320 SUNSHINE CRT., Dufferin / $585,000

NEW Price - 1320 SUNSHINE CRT., Dufferin / $585,000

Stunning, move-in ready 4 bedroom and 3 full bath Dufferin home in a sought-after neighborhood close to all amenities. Upper level has an open plan with vaulted ceilings, featuring completely upgraded gorgeous kitchen with new plumbing fixtures & sink, SS appliances, quartz countertop, maple excel cabinets & back splash. Spacious living room with brand new maple HW flooring, new fireplace mantle and tiles, & wood/iron bannister, 2-inch wood custom blinds. Off dining room, door leads out to outdoor living space with patio & slate patio, offering plenty of privacy. King size master suite with walk-in closet and 4 piece ensuite with upgraded double sinks and counter, faucet, & 5’ shower base for stand shower. Upgraded main bath with double sink vanity travertine top. Lower level is fully finished with ideal space for in-laws, featuring with newer kitchen cabinets & island and appliances, counters and back splash. 8 new light fixtures and fresh, modern paint throughout. Features Central air conditioning/heat pump, central vacuum, underground sprinklers, double garage. Newer sierra stone in the front porch. Level driveway with extra room for RV parking. $ 65,000 value of upgrades done for the last 2 years. The basement suite was previously rented for $1,200. All measurements are approximate & should be verified if important.

NEW Price - 4-726 DUNROBIN DR., ABERDEEN /$325,000

SOLD

NEW Price - 4-726 DUNROBIN DR., ABERDEEN /$325,000

SOLD

OPEN HOUSE: OCTOBER 13/SATURDAY/ 11:30 A.M - 1:00 P.M

3 Bedroom 3 bath level entry Aberdeen townhouse with city, river & valley views. Well-kept one owner home. Great open floor plan and lots of natural light throughout. The main level is sporting foyer, leading to the bright, cheery living room, dining room & kitchen with solid oak cabinets. Master suite with a 4pc master ensuite on the view side of home to take in city views. 2-piece powder room and off living room there is a great-sized patio with spectacular views, perfect for entertaining. Lower level highlighted with daylight walk-out basement and 2 bedrooms, a massive family room, utility/laundry room with good storage space, & a 4pc bathroom. Enjoy privacy on the patio off basement. Strata fee of $225/month. No rentals allowed (a roommate is ok) & one small pet allowed. One garage with a natural gas heater & an additional assigned parking spot (#4). Natural gas BBQ hookup. All measurements are approximate and to be verified by Buyer.

blog entry: October 9th, 2018 by Sarah

Just Listed -99 THOR DRIVE, SAHALI / $524,500

SOLD for $525,000

Just Listed -99 THOR DRIVE, SAHALI / $524,500

SOLD for $525,000

Location is unbeatable! 4 Bedroom, 3 full bath Sahali home in a sought after neighborhood. Close to all amenities including shopping, schools, TRU, transportation, & Royal Inland Hospital. Upper level highlighted with hardwood and gorgeous tile flooring throughout. Oak kitchen with tiled floor, pot lights, and ceiling height cabinets. It has level access off eating nook to covered patio with tiled floor and southern exposure. There's access off the dining room/living room & master bedroom to the front deck with views. Extensive retaining wall recovers a sizeable, low maintenance, easy care level backyard. Lounging in great outdoor living space will transport you to serene world. Patio door in 3rd bedroom makes a great family/TV room on the main with yard access. 3-piece ensuite with heated floor. 4th bedroom is currently used as office. Lower level features great-sized Rec room, laundry space with double basins, 3-piece bath. Rare opportunity to find ample parking accommodating up to 5 cars besides a double car garage. Underground sprinklers. Central A/C. HW tank (2016. Roof (2007). All measurements are approximate and to be verified by Buyer.

blog entry: August 31, 2018 by Sarah